Life insurance is a form of insurance that pays a beneficiary in the event of the death of the insured person. When a policy is purchased, a specific death benefit is chosen.

Life insurance is a contract between the policy owner and the insurance company:

- the policy owner (or policy payer) agrees to pay a defined amount called a premium.

- the insurance company agrees to pay a sum of money upon the death of the insured person.

- the beneficiary – the person or persons named by the policy owner – will receive policy proceeds (benefit) upon the death of the insured person.

Having young children is a common reason to purchase life insurance.

Do you need Life Insurance?

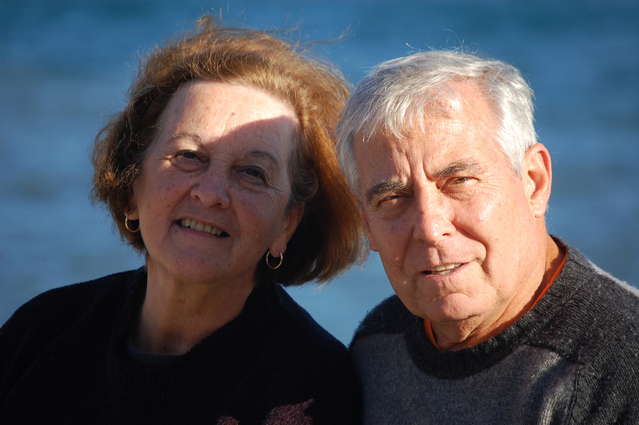

If you provide financial support, or provide such services as child care, cooking, and cleaning for your family, life insurance can help replace those contributions to the family if you should die. Older couples also may consider life insurance to protect a surviving spouse against the possibility of the couple’s retirement savings being depleted by unexpected medical costs.

If there are people who depend on you financially (including children, a spouse, a business partner, disabled or elderly relatives), having a life insurance policy will protect them when they can no longer count on your earnings.

If you have a mortgage or other financial obligations, a life insurance policy can help pay off debts and provide living expenses to the people you name as beneficiaries.

A key question to ask yourself is:

Are there people who depend on me financially? If so, life insurance can provide for their needs if you should die.For most people, the need for life insurance will be highest after starting a family and will decrease over time as children grow up and become independent. Life insurance can help make sure future needs are met and that your family maintains its standard of living, no matter what life brings.

How much Life Insurance is enough?

Multiply your family’s annual expenses, allowing for inflation, using the number of years in the future you believe your dependents would need your support. Remember to include the future costs of items you want to pay for such as a mortgage or educational expenses. Some options to consider:

How long will any children remain at home and be supported?

What are possible education costs for dependents, whether a child or an adult who might need to enter the workforce after the death of the primary provider?

Do you want to cover mortgage or vehicle payoff costs?

Some advisors recommend an amount of life insurance that equals or exceeds two to six times the annual income of the policyholder. However, this figure should be

adjusted according to the number of dependents, their relative ages and unique needs of the family.

What are different types of Life Insurance?

The primary purpose of life insurance is to provide for dependents should the family provider die. However, there are differences in types of insurance that allow different benefits and risks. Some types of life insurance are for a specific “term” or period of time. Some types of life insurance include the accumulation of cash value in exchange for a higher premium.

The next sections describe the differences between basic types of life insurance, as well as how to determine who should be insured.

The three main categories of life insurance are term life, whole life, and universal life, although there are options within each category:

Term life insurance

Term life insurance is the simplest and least expensive type of policy, with no cash value. A term life policy has only one function: to pay a specific lump sum to the beneficiary that has been designated, upon a specific event: the death of the insured person. The death benefit and the policy limit are the same — for example, a $200,000 policy pays a $200,000 death benefit. The policy protects your family by providing money to replace your salary, income or other contributions, as well as covering final expenses incurred at death.

As agreed in the contract, the premium must be paid, and if you stop paying, the policy ends (lapses.) You won’t owe the insurance company and they won’t owe you a refund for the premiums paid if it lapses before the end of the term.

If the insured person is still alive at the end of the term, you do not get your money back. A term insurance policy is over unless you can renew the policy. If you renew (if the policy has that feature), it will renew at a higher price reflecting the current age of the insured person. Term insurance has no buildup of cash value as some other types of insurance allow. (There are some term life insurance policies that offer a return of premium; be sure you understand the policy you are buying.)

Term insurance is for people who don’t need life insurance for an indefinite period of time. It provides for people who depend on you, but generally ends by the time children are grown and independent, often when the policy owner is ready to retire.

Whole life insurance

Other types of life insurance provide both a death benefit and a cash value. Their premiums are higher than term life premiums, because they fund the cash value account in addition to providing insurance. These policies are often referred to as cash value policies.

Whole life insurance is designed to provide protection for dependents while building cash value. The policy pays a death benefit if the insured person dies. However, there is also a savings component (called cash value), which builds over time.

In addition to paying a death benefit, a whole life policy allows accumulation of cash value that the policy owner receives if the policy is surrendered.

The premium is fixed and won’t increase during the lifetime of the insured person as long as premiums are paid as agreed, for the entire time the policy is in force. The policy pays upon the death of the insured or when the insured person reaches a specific age stated in the policy.

Whole life policies cost more than term insurance, but have the benefit that the policy builds cash value.

Term insurance does not build cash value.

Universal life insurance

Different types of life insurance meet the needs for people in various stages of life. People should review insurance coverage and, when necessary, change the type of policy as their needs change.

Universal life insurance gives the policyholder more control over premiums, provides permanent protection for dependents and is more flexible than a whole life policy. It pays a death benefit to the named beneficiary, and allows the ability to accumulate cash value.

Generally, a universal life policy provides flexibility by allowing the policy owner to change the death benefit at certain times, or to vary the amount or timing of premium payments.

Both the universal life policy and whole life policy allow withdrawals or loans against the cash value of the policy. Another type of insurance, variable life, offers additional investment options in separate accounts. It also requires that the policy owner take time to manage the investments.

Should I buy Life Insurance for my children or for my parents?

The main reason to take out a life insurance policy is to replace income should the insured person die. Life insurance helps replace the lost income or services that the insured person provided to the family.

Children, and people who are older or retired, or who have no dependents, generally do not need large amounts of life insurance.

Insurance on children is sometimes purchased to assist with burial expenses, or to build cash value, which can be transferred when the child turns 21.

Should a stay-at-home spouse have Life Insurance?

If a stay-at-home partner dies, the survivor may have to pay someone to take over childcare, laundry, cleaning, cooking and other tasks.

Add up the expense of replacing these chores and consider the financial impact when deciding if there is a need to insure a spouse’s contribution to the family.

For additional information on purchasing Life Insurance, Health Insurance or Annuities, please visit the National Association of Insurance Commissioners (NAIC) website.