Commissioner Mulready Addresses Future Resolution to CVS/Caremark 90-Day Prescriptions

| By Britney Han | 0 Comments

For Immediate Release:

May 11, 2023

Commissioner Mulready Addresses Future Resolution to CVS/Caremark 90-Day Prescriptions

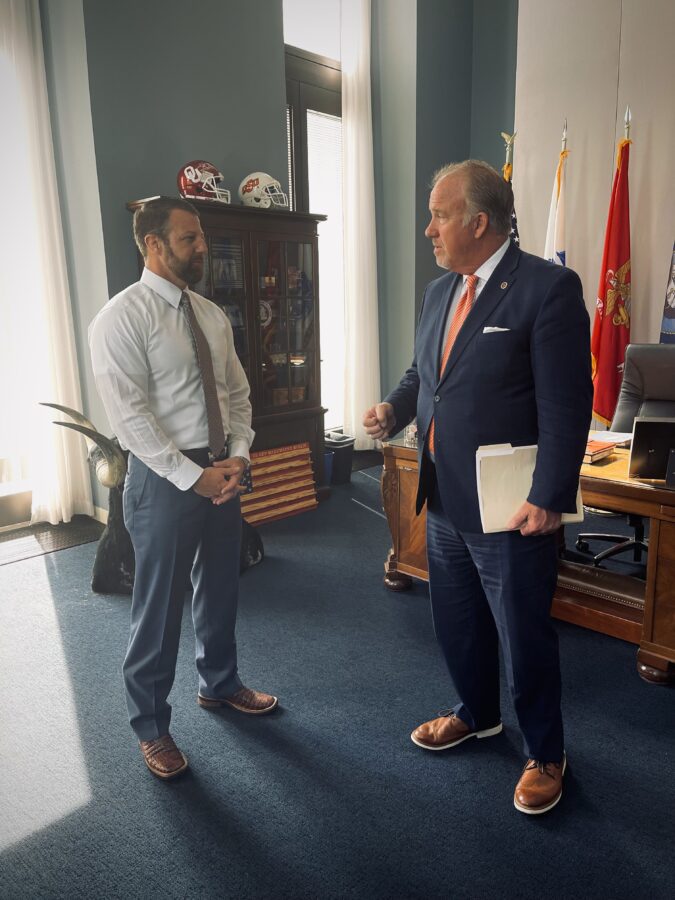

OKLAHOMA CITY – Oklahoma Insurance Commissioner Glen Mulready announced today that after conversations with large employers and CVS/Caremark, there are remedies coming to those nearly 300,000 Oklahomans impacted by Caremark, LLC’s (Caremark) decision to do away with 90-day and mail order pharmacy benefits.

In March, the Oklahoma Insurance Department (Department) filed an administrative action against Caremark for alleged violations of “steering patients” to CVS pharmacies and prescription mail-order services. A hearing was set for May 25, 2023, where the Department will seek to censure, suspend, place on probation or revoke the Pharmacy Benefit Manager (PBM) license of Caremark. In addition, the Department will seek restitution and/or levy fines for each alleged violation.

Since the filing, the Department has been in discussions with large client employers, such as, AT&T, Southwest Airlines, and Phillips 66. In addition to those conversations, we have met with CVS/Caremark, and they now have a plan in place to allow 90-day and mail order options for at least 80% of the plans by July.

“I am encouraged by the recent change of course and focus of Caremark to develop a plan with their employer groups that will resolve the current issues facing many Oklahomans.” Mulready said. “We have met with their leadership, and I am committed to making sure this plan becomes a reality. We were originally informed that solutions would not be available until March of 2024, so we look forward to this resolution taking place in the coming months.”

For more insurance information, please contact the Oklahoma Insurance Department at 1-800-522-0071 or visit our website at www.oid.ok.gov.